Expats in Poland: Are You Saving for Retirement the Smart Way?

As an expat in Poland, let alone expat being a freelancer or solopreneur here, you’re used to taking charge of your future: your income, your business, and your success. But what about your retirement

As an expat in Poland, let alone expat being a freelancer or solopreneur here, you’re used to taking charge of your future: your income, your business, and your success. But what about your retirement?

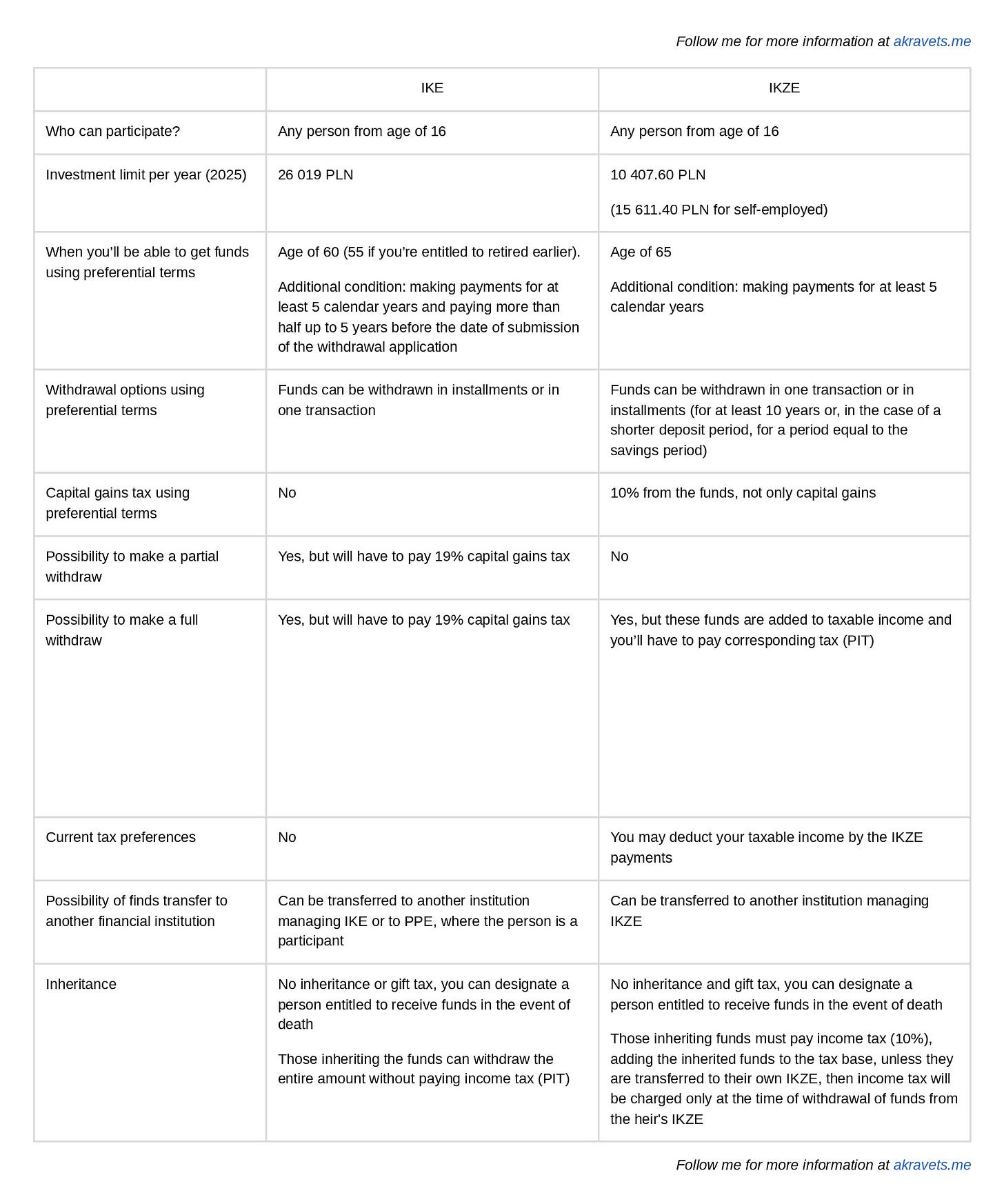

Luckily, Poland offers two powerful tax-advantaged accounts designed for long-term savings: IKE (Individual Retirement Account) and IKZE (Individual Retirement Security Account). The best part: you can maintain them and use their preferential options even if you leave Poland and become tax non-resident (you new tax residency may require you to pay some tax though; I’m not a tax consultant, you need to consult with a tax consultant regarding this or any other tax questions).

IKE (Individual Retirement Account) and IKZE (Individual Retirement Security Account) are voluntary products, i.e. part of the so-called third pillar of the pension/retirement system in Poland.

Both types of accounts may seem quite similar. It's not just about the name. The programs are offered by the same institutions: TFI (investment funds), banks (deposits), insurance companies (life insurance policies with UFK, Insurance Capital Funds) and brokers (stocks, ETFs, treasury bonds, not necessarily Polish).

You may also like Individual Retirement Accounts In Poland: What Are The Options?

The main difference between IKE and IKZE is the taxation. In the case of the latter, person feels the tax relief immediately, writing off the funds paid in from taxable income.

✅ IKE (Indywidualne Konto Emerytalne) main features

Tax benefit: No capital gains tax (19%) on withdrawals after age 60*

Annual contribution limit (2025): 26 019 PLN

Investment options: Stocks, bonds, mutual funds, ETFs, and more

✅ IKZE (Indywidualne Konto Zabezpieczenia Emerytalnego) main features

Tax benefit: Contributions are deductible from your income tax, reducing what you owe today

Annual contribution limit (2025): 10 407.60 PLN and 15 611.40 PLN (for self-employed)

Tax on withdrawal (10%) after age 65*

* Terms & Conditions apply

Check For Expats in Poland

IKE and IKZE Accounts Comparison:

Biggest downside? These accounts are in PLN only, so you carry a currency risk in case you’re not planning to retire in Poland and spend your savings here.

How Expats Can Use These Accounts:*

1️⃣ Prioritize IKZE first: you get immediate tax savings each year.

2️⃣ Use IKE for long-term, tax-free capital growth.

3️⃣ Invest wisely: diversify across assets that align with your risk tolerance.

4️⃣ Start early: compounding works best over time.

* One of the options, each case has to be studied individually

Connect with me for more information

Unlike the state pension system (ZUS), these accounts give you control over your money and ensure flexibility in retirement. If you’re building a business or saving today, don’t forget to build your financial freedom for tomorrow!

Disclaimer: I solely provide general investment education for informational purposes and do not provide investment or tax services or personalized investment or tax advice. Always invest through a licensed financial services company. Even when following the best possible investment practices, investing in the financial markets involves the risk of loss. You should always consider your individual circumstances carefully before making any investment decisions. All investment decisions remain your own responsibility. Past performance does not guarantee future results.1